Financial independence. The ability to walk into your boss’s office, tell him to pound sand, and never have to worry about money again.

Over the past 10+ years, there has been a growing movement of people adopting a low-time-preference strategy of saving and investing with the goal of achieving financial independence early in life, putting themselves in a position to retire earlier than the traditional age of 65. Hence the acronym, FIRE: Financial Independence, Retire Early.

What is FIRE, exactly?

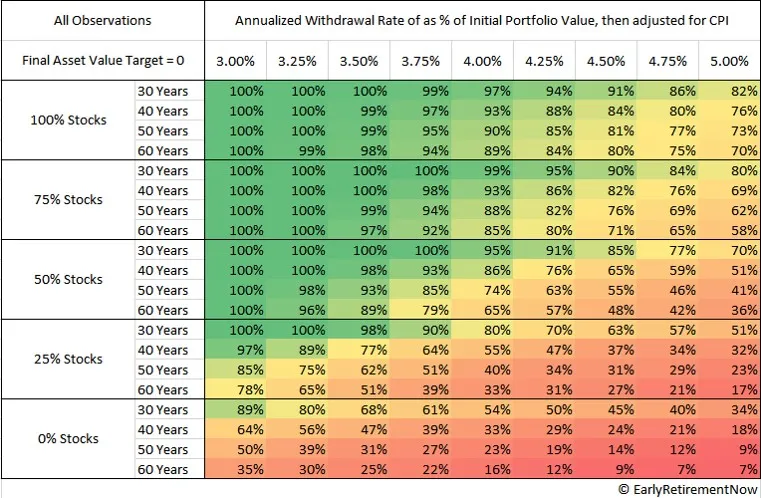

The strategy is pretty simple. Live below your means, and invest excess savings to build an investment portfolio with a value 25x your annual expenses. Why 25x? A portfolio of this size allows for what is referred to as a “safe withdrawal rate” (SWR) of 4% per year to cover your expenses without drawing down meaningfully on the value of your investments.

The SWR is based on research called the Trinity study, which analyzes historical returns of stock + bond portfolios in the context of supporting a 30-year retirement timeframe. Here is a short overview of the study’s findings:

“For the annual data between 1926 and 1995, they found that a portfolio consisting of 50% large-capitalization stocks and 50% high-grade long-term corporate bonds would have provided a 95% chance for success in supporting inflation-adjusted annual withdrawals starting with an initial withdrawal of 4% of the portfolio value at the time of retirement.”

Given the historical returns of an investment portfolio as outlined in the Trinity study, a 4% withdrawal rate implies that for every $40,000 of annual expenses you have, you need to have saved and invested $1,000,000. If you spend $100,000 every year, you need a $2.5 million investment portfolio to reach financial independence. Once achieved, you can fund your lifestyle without an income by selling down your investments gradually over time. According to the study, this portfolio will last 30 years before you run out of money. In fact, most of the time, you’ll end up with a larger portfolio of invested assets at the end of that 30 year period than at the start. Financial independence, truly!

Intuitively correct

Truth #1: The nature of money is not what it seems

Most people don’t think about the nature of the money they use. It’s taken as a given – something that is so embedded in everyday life that it doesn’t even cross their minds to consider. The reality of the monetary system, however, is disconnected from the way we experience using money every day.

We talk about and use money today as if we are passing around physical tokens that represent value, like paper cash or gold coins. But when you pay your friend back for a beer using Venmo, this is absolutely not what happens. Venmo is an intermediary, which sits among a series of other intermediary banks and financial institutions. The act of paying your friend happens by way of those intermediaries updating their internal ledgers. These ledgers are distributed (sound familiar?) across the computer servers of governments, banks, and other financial institutions, and are maintained through a complex accounting process borne from the legal right granted to this elite group of people to decide who owns what and who owes what to whom.

If you trace those ledger entries, those movements of “money”, back to their origins, what you will find is…debt. That’s right. The money we use today comes into existence through the process of a financial institution creating a loan and a bank deposit, which are assets and liabilities of banks, respectively. In other words, a bank that makes a loan is not giving the borrower money they have sitting in a vault somewhere. They are lending new money into existence. The money we use today is based on debt.

This leads us to truth #2.

Truth #2: Life continually gets more expensive

Because the fiat monetary system is based on debt, there must always be credit expansion, an increasing amount of money “printed”, in order for the system to remain functional. That means that the value of this money always trends toward zero. It is engineered to lose purchasing power over time.

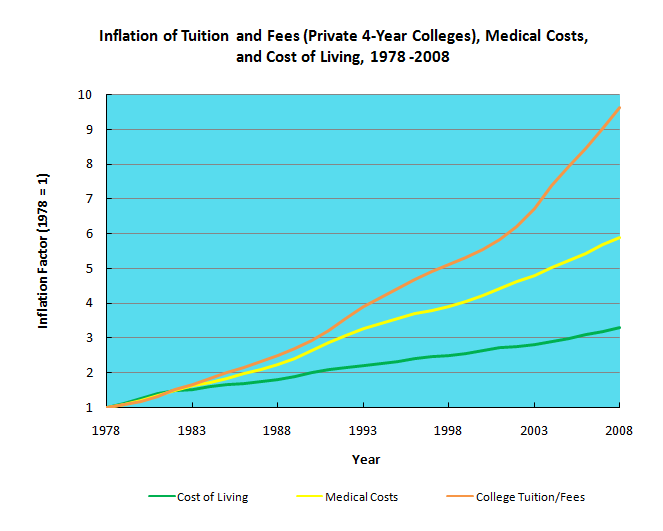

The effect of this constant debasement is most visible in the price of goods and services for which increasing the supply is difficult. Have you ever wondered why the cost of housing, education, and health care goes up year after year? There are a lot of inputs to the price of each particular good or service. Each person’s lifestyle and combination of expenditures is unique. However, these three components are relevant to a majority of people, as most of us need to buy a home or pay rent, send our kids to college, and pay for health care (especially as we grow older).

These are examples of critical expenditures that have been under constant upward price pressure for the past 40+ years. The effect is directly related to the continual debasement of the money we use. Again, our money is engineered to lose value.

This leads us to truth #3.

Truth #3: Saving money you’ve earned is not enough

“In 1980, the price to attend a four-year college full-time was $10,231 annually—including tuition, fees, room and board, and adjusted for inflation—according to the National Center for Education Statistics. By 2019-20, the total price increased to $28,775. That’s a 180% increase.” – Forbes

The cost of a college education for your child increasing at a compound annual growth rate of 5.31% means you need to save that much more every year to keep up. Only after you’ve accounted for that cost increase can you have a net positive savings rate. It’s no surprise, then, that most people are forced to save and invest (read: add risk) if they want to grow their wealth enough to afford an ever-increasing cost of living and build a nest egg for retirement.

You have to earn your money twice – once when you work for it, and again from investing with it. You can’t just put the money you earn away in a riskless fashion to save for retirement.

FIRE proponents understand this reality intuitively, which is why they advocate for investing excess savings in a simple, cost-effective way – stock market index investing.

The stock market as a savings mechanism

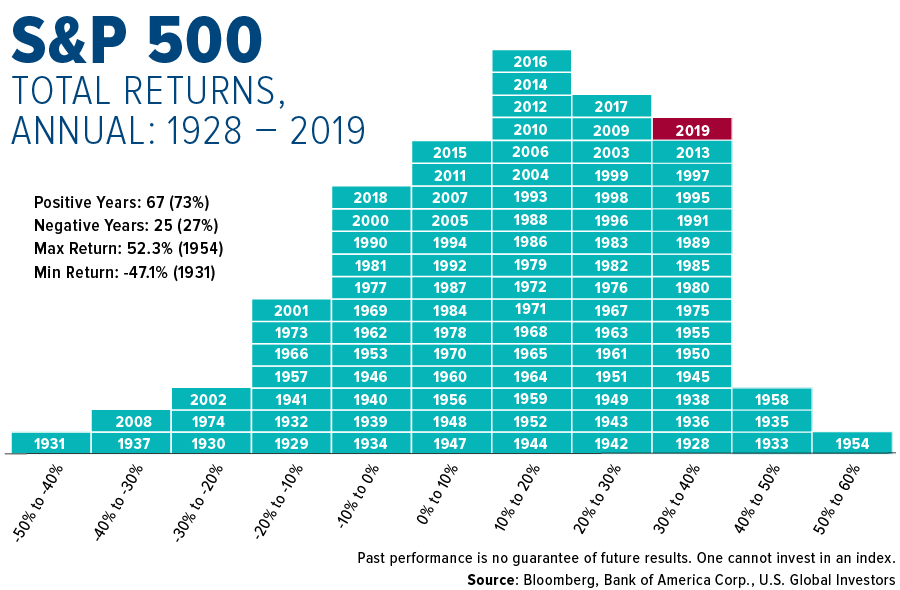

Stock market index funds are the tool of choice for FIRE practitioners to build an asset base that grows over time, hopefully above and beyond their individual blended inflation rate. The US stock market has returned 8-10% on average in nominal terms over the last 100+ years. If after adjusting for your increased cost of living, your portfolio is able to continually grow, you have reached Financial Independence and can Retire Early. FIRE!

One of the people most influential in the FIRE community is Mr. Money Mustache, who sums up the reasoning for choosing stock index funds as the primary savings/investment vehicle:

“The value of stocks will go up as the earnings of the underlying companies goes up. A portion of the ongoing earnings will always flow to the shareholders as dividends. And all this happens because of the natural ingenuity of hardworking humans making things at a profit, and continuing to advance our knowledge and technology and make us all more productive in every field.

There may come a time when we can no longer advance, but based on the fact that we’re still driving around in gas-burning tanks and Home Depot is still doing all of its computing on green-on-black mainframe computers that kick you back to the beginning of the order if you make a typing mistake, I’d say we have at least a lifetime left to go in this department.

So, stocks go up and pay dividends over time, and they have since the beginning of modern commerce. The total return has averaged a very lumpy but fairly dependable 10 percent per year before inflation, 7 percent after inflation.

5 of the 7 percent comes in the form of rising stock prices, and the other 2 comes from dividend payments directly from the company to you. When you’re in your ‘Stashing stage’, you just let these dividends automatically reinvest in more stocks which creates a nice compounding effect.

But WHICH stocks do I want to buy to make this free money?

This is the easy part. You buy ALL of them.

The best minds in finance have done countless studies on this for over 40 years. What they find is that the best way to make money in the stock market is to simply buy an ‘index fund’, which is a mutual fund that automatically buys appropriate ratios of every major stock in your country’s stock market, with no magic and guessing of which stocks are better than others.

The reason the index fund wins statistically is because it can be run by a simple automated set of rules – no need to pay 350 million dollar salaries to the hotshot traders running the ‘Aggressive Growth Fund’ down the street. Because there are millions of people, both smart and dumb, squabbling over the value of each stock, the Index Fund benefits and suffers from all the individual stock performances. But overall, you get the average performance of all this squabbling.”

To sum up it up, FIRE proponents favor index funds for the purpose of saving because they

- have a history of compounded growth over a long period of time,

- are widely diversified, which shields investors from the fortunes of individual companies,

- have a relatively low cost to hold,

- are cheap and easy to buy and sell (unlike real estate, for example), and

- require no special skills or ongoing work to maintain.

However, there are a number of downsides and risks associated with using the stock market as a savings mechanism.

Stock market returns are not evenly distributed

While the average return on the US stock market index is 8-10%, the distribution of those returns can cause problems, especially in the first few years of retirement. This is referred to as sequence of returns risk, and under some circumstances, your retirement may be put in jeopardy.

If you reach your FI number (25x your expenses) and retire, the first few years of your retirement are critical to whether or not your portfolio will support your lifestyle over the coming years. For instance, if in the first year of your retirement, your portfolio drops in value by 30% because the economy is headed toward recession, and the cost of living skyrockets because of supply chain issues and an excess of money printing, all of a sudden your retirement is put at risk. This is because in order to fund the same set of expenses, you’ll need to sell down a larger portion of your portfolio than the 4% that you originally based your FI number on.

You might not have access to the right stock market

The FIRE movement was spearheaded and is dominated by Americans. As I mentioned above, the US stock market has returned 8-10% annually, in large part due to US dominance on the world stage for such a long time.

American businesses have enjoyed tailwinds from this dominance which are not necessarily available to businesses outside the US. One major tailwind has been the fact that America can export inflation abroad because of the dollar’s position as world reserve currency. Other positive influences include relatively strong property rights and an abundance of natural resources.

But people and businesses in a lot of other countries are at a disadvantage in this regard, and the investment opportunities available to them may not include US stock indices. If you are not American, your results may be negatively impacted if the stock indices or other investments you do have access to yield lower returns or have increased volatility.

You might not have access to any stock market

Index funds have counterparty risk

Taxes and fees are a drag on your returns

Stocks are not money (and never will be)

Ideally, you wouldn’t have to put your savings at risk to overcome an otherwise consistent loss of purchasing power. Storing value directly in money avoids the downsides associated with investing. You would no longer have the risk of losing your money on a nominal basis from the value of your investments falling or your asset manager failing. You also would not be subject to management fees and taxes on dividends. As an added benefit, you would be able to spend your value directly into the economy without transaction costs associated with selling the assets you own. Using stock index funds as a store of value has worked relatively well to shield people from a loss in purchasing power over time. That said, stocks (and other investments) are not money and cannot offer the many benefits that money itself provides.

Bitcoin fixes this

Getting back to saving alone

Bitcoin has many features that make it the best money the world has ever seen. No-one controls it. It is permissionless and open to anyone. It can be sent across the world instantly, for a very low cost, and at any size – large or small. It is resistant to seizure and censorship. It is cheaply and easily verifiable and cannot be faked.

But arguably the most important feature, especially in the context of storing your hard-earned value, is that bitcoin is absolutely scarce. It has a hard-capped supply of 21,000,000 units that cannot be changed. One bitcoin will always equal one twenty-one millionth of the total supply.

This is in stark contrast to the supply of dollars, which is consistently increasing. Nobody on the planet, including those in charge of the current monetary system, knows what the supply of dollars is at any given time or what it will be in the future. The one thing we do know is that because our money is engineered to lose value over time, that’s exactly what will happen. Accepting the certainty of monetary debasement is not an option, so instead we are forced to invest in other assets that are harder to produce than fiat money but also have virtually unlimited supply.

In a world where bitcoin is the standard money, you can simply use it as a savings vehicle and skip the risky investing part. Because the supply of bitcoin is strictly limited, and because the world becomes more productive over time (as Mr. Money Mustache stated in the quote above), the purchasing power of bitcoin will continually increase.

From there, the same FIRE rules apply. Assuming the economy becomes more productive at a 4% per year pace or higher, you can apply the same 4% rule to your bitcoin savings. Save 25x your annual expenses, and you can fund your retirement.

The current reality is even better than that. Because it is relatively new, bitcoin is still early in its adoption cycle. Historical returns for bitcoin have been well north of the 8-10% stock market returns. As adoption of this vastly superior, fixed-supply money accelerates, that trend can be expected to continue.

The availability of absolute scarcity in money changes the game entirely. No longer is there no other option than to play the fiat financial games that force you to risk the fruits of your labor in the stock market. Instead, you can use bitcoin as money that is perfect for saving, because that’s exactly what it is.

What about the volatility?

While it’s true that bitcoin offers a tool for direct money savings, the most obvious objection given for this line of thinking is related to the volatility of its price. This objection has been especially loud over the last year as bitcoin’s price has fallen from a high of almost $70,000 to a low around $15,500 (around $23,000 at time of writing).

Yes, bitcoin is currently volatile, but it’s important to understand why. I cover that topic in The Three Key Tenets of Bitcoin.

Cash savings with asymmetric upside

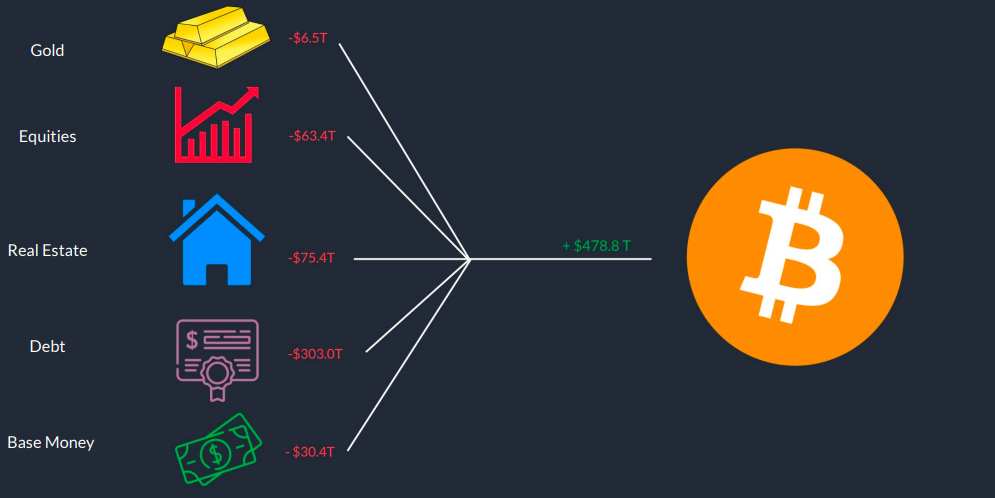

People use stocks, bonds, real estate, gold, and art as savings vehicles because the money itself is broken. The need to escape perpetual debasement of their dollars, euros, and yen leads people to seek refuge in riskier assets to maintain or grow their purchasing power. As a result, these assets enjoy a monetary premium.

Bitcoin’s total addressable market (TAM) is the entire world’s monetary premium. This insightful report from the Blockware Solutions team examines how bitcoin can demonetize legacy store-of-value asset classes and what that means for its purchasing power. The report estimates the monetary premium given to gold, equities, real estate, debt, and base money total to about $480 trillion. If just 5% of that value transfers to bitcoin, its implied market capitalization would be $24 trillion. That’s about 50x larger than it is right now!

Bitcoin stands to absorb that monetary premium because it is a vehicle for saving that is not subject to counterparty risk or debasement. It’s simply a better option, and it stands to reason that many people will choose it for the purpose of saving.

A deep dive into the bitcoin rabbit hole tends to lead to the conclusion that its adoption will continue apace, leading to its value rising exponentially. Bitcoin represents the greatest asymmetric bet the world has ever seen.

True financial independence

Bitcoin promotes financial independence beyond being such an incredible instrument for saving. With bitcoin, you can take complete control over your wealth. Unlike all other financial assets, bitcoin can be stored and transported at any scale without reliance on third parties, custodians, banks, or governments.

You don’t have to wait for banking hours to access your money. Or depend on an intermediary to send a payment. Or pay expensive fees to verify the gold or art you bought is real. You’re not subject to hefty transaction fees, managing tenants, annual property taxes, or dealing with maintenance issues.

And you can be absolutely certain that your piece of the pie cannot be diluted. Bitcoin creates financial independence in the truest sense of the word.

Wrapping up with further resources

FIRE practitioners intuitively understand that the money is broken. In response, they allocate savings toward investments in the hope of outpacing their ever-increasing cost of living. This approach works, but it has many downsides. Bitcoin ultimately fixes the money to make investing for purchasing power preservation unnecessary.

My personal approach to finances has been shaped by the FIRE movement. Being aware and intentional about spending, saving, and investing creates a mindset that breeds financial well-being, and I have benefited immensely from adopting it. I still track my expenses and use the 4% rule as a guidepost for achieving financial independence. But instead of saving in stocks, I save in bitcoin.

Understanding why bitcoin is important takes a little bit of time and effort. If you follow the FIRE strategy and I’ve piqued your curiosity, be sure to check out my bitcoin page for some great learning resources.