In September 2022, I was honored to be welcomed as a speaker for Bitcoin Day in Nashville, TN. One of the three tenets of bitcoin is “not your keys, not your bitcoin”. The ability to fully and independently control your own money is one of the most important features that makes bitcoin valuable.

This presentation is meant to highlight what I see as a large risk to bitcoin and bitcoiners. It’s entitled, “Self-custody is non-negotiable”, because I believe that a culture that accepts nothing less than widespread distribution of the private keys that control bitcoin is absolutely essential for bitcoin itself to succeed.

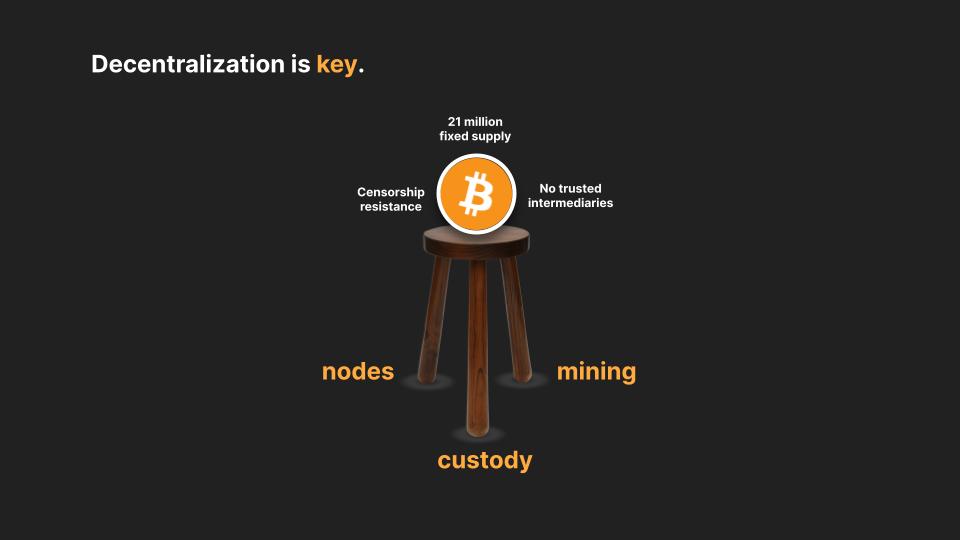

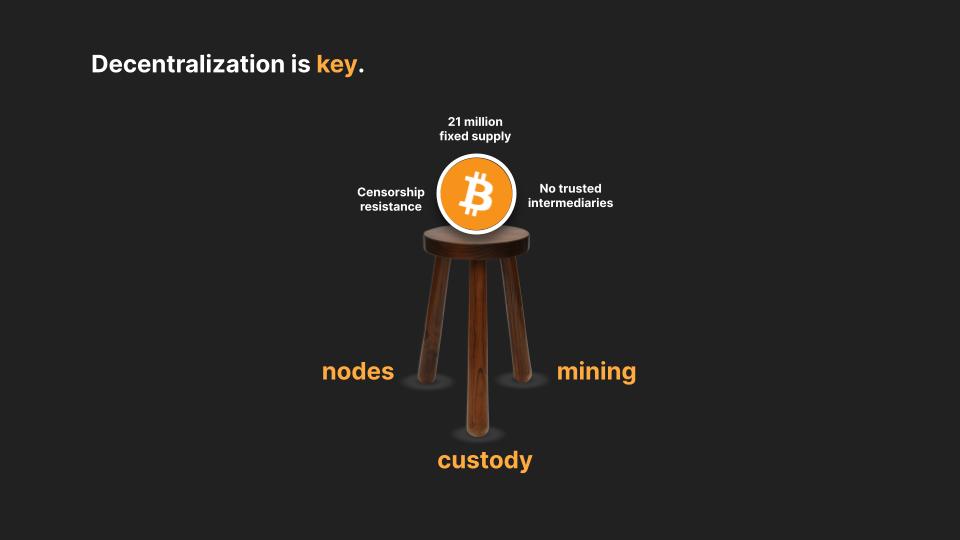

Decentralization is key to bitcoin’s success. Bitcoin is such a beautifully designed system of checks and balances, game theory, and incentives, all of which contribute to the emergent properties it exhibits to make it the best money the world has ever seen.

Bitcoin is built on a foundation of decentralization, across nodes, mining, and custody of the bitcoin asset. I’m depicting this as a three-legged stool where each of these aspects is critical to holding bitcoin up. If one of those legs gets cut out from underneath it because it becomes too difficult to remain decentralized, the whole thing falls apart.

Bitcoin’s success in becoming the next global money is absolutely dependent on our ability as bitcoiners to maintain decentralization on these three aspects of the system. Those emergent properties of an absolutely fixed supply, censorship resistance, and the ability to operate without trusted intermediaries, provide for the world, for the first time in history, a financial asset that can be completely free of counterparty risk.

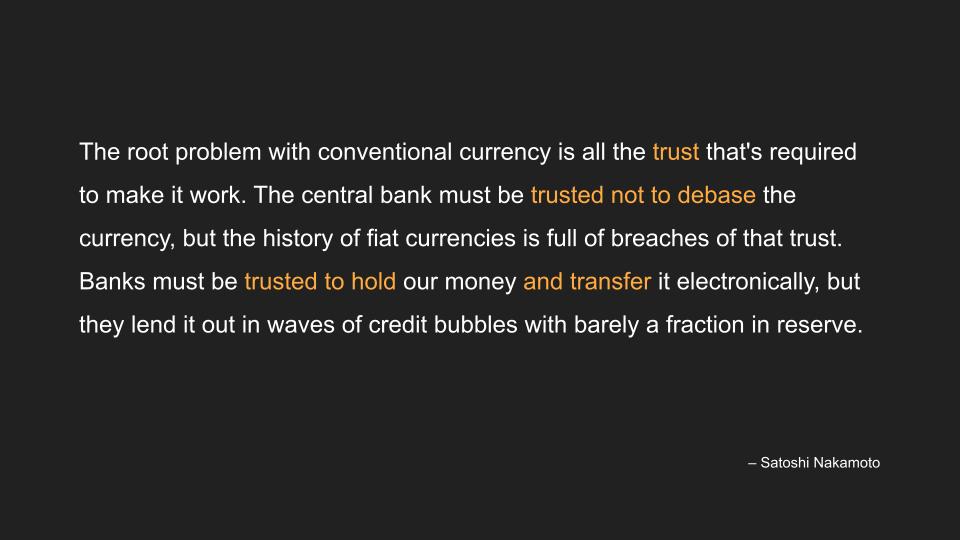

In fact, you can make the case that bitcoin’s value proposition can be boiled down to the fact that it is a monetary system with no inherent counterparty risk. This is a quote from Satoshi in the forum post where he announced bitcoin. If you’ve been around bitcoin for a while, I’m sure you’ve seen this before. I’ve highlighted a few places where he refers to trust.

The reality of the global financial system that has been developed over the last 70 years is one where trusted intermediaries are required for almost all economic activity. We rely on banks and other financial institutions to store and send money on our behalf, which was born from the fact that gold, which had developed over thousands of years into the main monetary standard across the globe, is less than ideal for conducting transactions over distance. An evolution of the economy to be more global necessitated abstracting value above base-layer gold, and we ended up with the fiat financial system.

Because of this requirement to have intermediaries involved in all financial transactions, the money we use is political. These centralized intermediaries are vulnerable to various political pressures that lead to censorship. We have KYC/AML, OFAC lists, bail-ins and bailouts, frozen accounts, and a financial data free-for-all that feeds right into the surveillance state.

And finally, using the fiat financial system means having to make economic calculations, at both the personal and business level, with money that is engineered to be debased. A credit-based economy means growth at all costs, lest the ever-growing global debt burden collapses in on itself like a black hole, creating financial destruction of unbelievable proportions. That is not an option for the regimes in power, because allowing this to occur risks revolution, perhaps violently, and a potential overthrow. Since that is not an option, the road always taken is one of debasement, and that debasement leads to a shortening of time preference that destroys our capital stock instead of building it up over time, making it harder and harder to get by for average people.

All of this can be included in a definition of counterparty risk that is relevant to the way we interact with money and near-money store-of-value assets in our daily lives.

Stepping back a bit, I want to quickly take a look at a standard definition of counterparty risk – this is from the OCC. Satoshi’s use of the word “trust” expresses the counterparty risk concept that’s being described here. Wherever there is trust in a financial arrangement, you are relying on someone else, your counterparty, to fulfill an obligation to you. That may fall apart for a variety of reasons, which Satoshi was touching on in that quote.

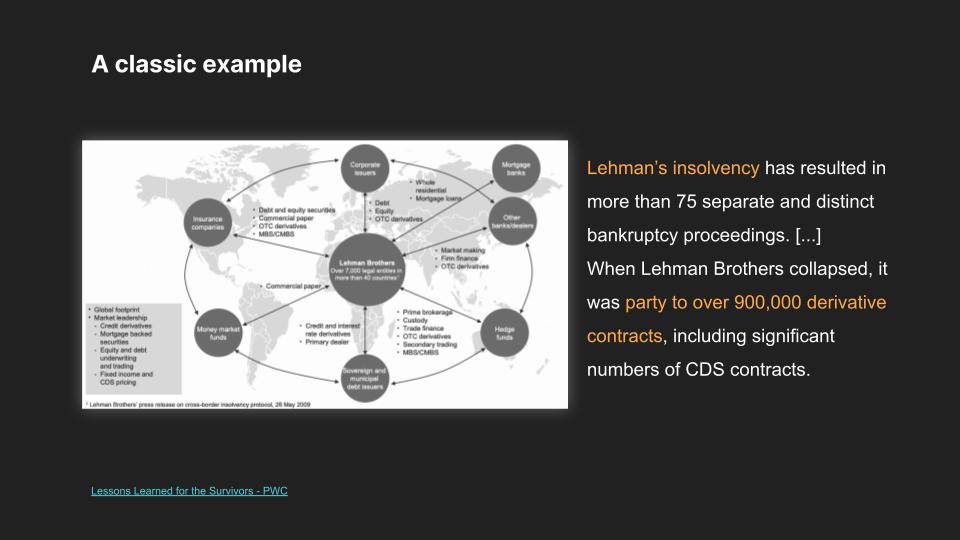

A classic example of this in the legacy financial world is the fall of Lehman Brothers in 2008. We’re all familiar with the broad story here, but this is such a perfect example of how deeply entrenched counterparty risk can lead to a catastrophic cascade of economic damage.

This picture and quote is from a report released by PWC in 2009, in the wake of the Lehman collapse. Lehman was such an interconnected financial institution that its collapse directly resulted in more than 75 distinct bankruptcies, and it was party to over 900,000 derivatives contracts, including significant numbers of CDS contracts.

Imagine you had the foresight to predict the great financial crisis and bought CDS contracts as protection, only to see those contracts become worthless because you bought them from Lehman Brothers. That’s counterparty risk in the classic sense.

As I alluded to before, I want to broaden the scope of thinking when it comes to the concept of counterparty risk.

All legacy financial assets have counterparty risk built into them in multiple different ways. Some of this is unavoidable due to their physical nature, as is the case with gold, real estate, and physical cash dollars. Some of this is unavoidable due to the fact that they are instruments issued by, and connected to, centralized enterprises, such as companies and governments, where the value of those instruments are strongly influenced by the good or poor governance of those enterprises. Stocks, bonds, and real estate serve specific purposes and provide utility in the real world, even though there’s no way to fully remove their inherent counterparty risks.

Regardless, because of all the trust and counterparty risk that is built in, they are permissioned and subject to control, confiscation, and debasement. That makes them suboptimal as a replacement for money. Unfortunately, that is exactly what has happened. The fiat financial system pushes people to store value in assets that are laden with counterparty risk simply because there is no other option (leaving aside bitcoin, of course, which I’ll get to).

Let’s go through this in a little more detail. Whether we’re talking about dollars, gold, real estate, bonds, or stocks, all of these assets are subject to someone else’s ability to increase their supply and dilute your holdings. In Satoshi’s quote from the previous slide, he’s specifically talking about the counterparty risk you have to governments who are entrusted not to debase the currency, but constantly breach that trust. All of these other assets are subject to that risk too – more gold is constantly mined, more houses are constantly built, and companies can issue new equity shares and bonds at their own discretion. The point is, the supply of all of these legacy financial assets is beyond your individual control, regardless of having no distinct person or group to point to in some cases, such as gold mining. When it comes to ownership rights and title, if you want to make sure you actually own these assets and have the exclusive right to use them, you are reliant on centralized institutions and governments. Storing and transferring all of these assets, small amounts of cash and gold aside, requires an intermediary. There’s no way to scalably store large amounts of gold or cash without trusting someone else. You can hold small amounts, of course, but that doesn’t get you very far. And there’s no way at all to transport cash or gold across the world in a scalable way without trusting someone else either. We’ve all heard the stories of gold-plated tungsten bars and counterfeit cash, and each one of these assets is subject to government officials and/or management teams being competent.

All of these considerations represent a type of risk to a counterparty – someone else that you rely on to fulfill a financial or maintenance obligation. Again, this is the “trust” that Satoshi was referring to.

An absolutely fixed supply of 21 million bitcoin, censorship resistance, and no requirement for trusted intermediaries is enforced through decentralization of the system. The result is that all of the points of counterparty risk we just covered for legacy financial assets that people are using to store and transfer their value can be completely eliminated with bitcoin.

There is no one in control of the supply of bitcoin, so you can never have your share of the supply debased. Ownership rights and title are guaranteed through cryptography, private keys, and the most powerful computing network in the world, which means you have no direct reliance on a government or corporation to enforce the rights to your money. Storing and transferring bitcoin is scalable natively for large and small amounts and for short or long distances, so no trust is required. Ensuring the asset you receive is legitimate doesn’t require specialized knowledge, or an expensive process to assay; it just requires cheap hardware and an internet connection to run a bitcoin node. And you have no dependency on government officials or corporate management teams to ensure the asset you own has a solid and durable organization underneath it. You can simply store your proof of work directly and independently as a fully sovereign individual – like a psychopath.

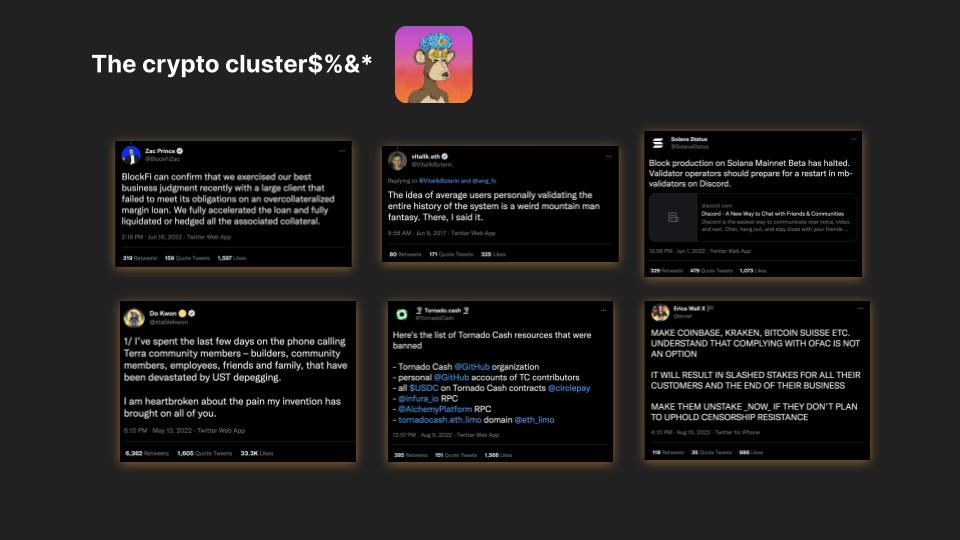

I also want to point out that “crypto”, “web3”, and “DeFi” don’t address any of these counterparty risks the way bitcoin does. It’s no wonder that Vitalik Buterin thinks it’s a “mountain man fantasy” for plebs like us to be running nodes. These projects are not meant to solve meaningful problems, so they don’t need to be meaningfully decentralized. DeFi is neither decentralized nor finance. This is fiat reimagined, with middlemen and counterparty risks abound, playing fiat games for fiat prizes like monkey jpegs. And when stressed, they are just as vulnerable to censorship and control as the legacy financial world is. By the way, I did not actually pay for this monkey jpeg. Believe it or not, all I had to do was right-click and save!

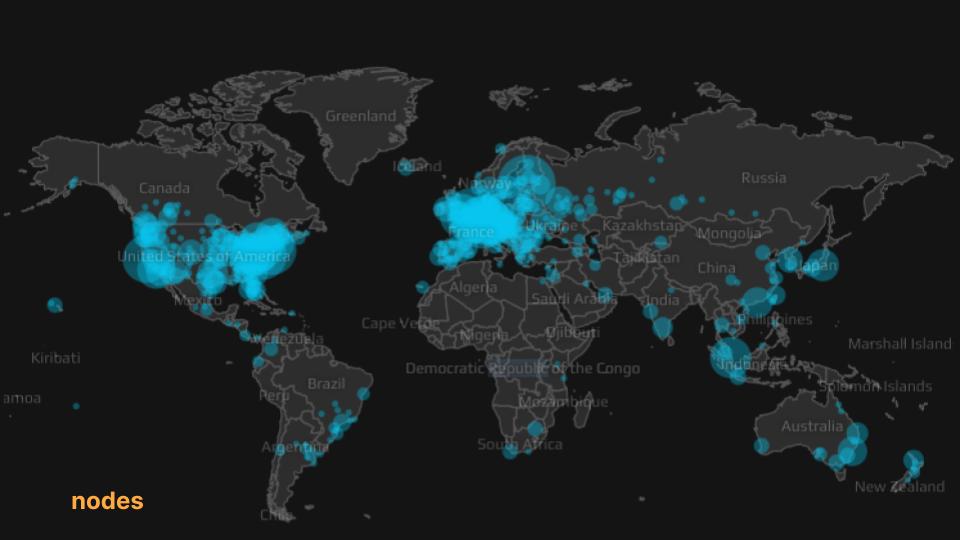

The biggest test for nodes was the fork wars in 2017. Bitcoin has grown a lot since then, so I imagine most bitcoiners today did not live through, much less participate in, that pivotal moment in bitcoin’s history. For me, even though I first bought bitcoin in 2014, it wasn’t until after bitcoin fought off the fork wars attack that I really started to understand what bitcoin was and why it was so important that it be easy for people to run their own nodes and enforce the rules that THEY want to opt into.

The ethos of bitcoin and the north star of maintaining decentralization, which is the whole point of this crazy experiment, is so critical to ensuring it cannot be co-opted by the state and corporate class, who would love nothing more than to maintain their grip on the monetary system. The outcome of the fork wars made it abundantly clear that there is decentralization of bitcoin nodes, and all the evidence I’ve seen shows that it’s stronger than ever. The fact that you can run the bitcoin software on a raspberry pi with a satellite connection is really amazing, and it’s never been easier to do so. Because of this, and because of the culture that is built into bitcoiners, and because nodes are decentralized throughout the globe, I believe that bitcoin is likely past the point where it can be overtaken directly from that angle.

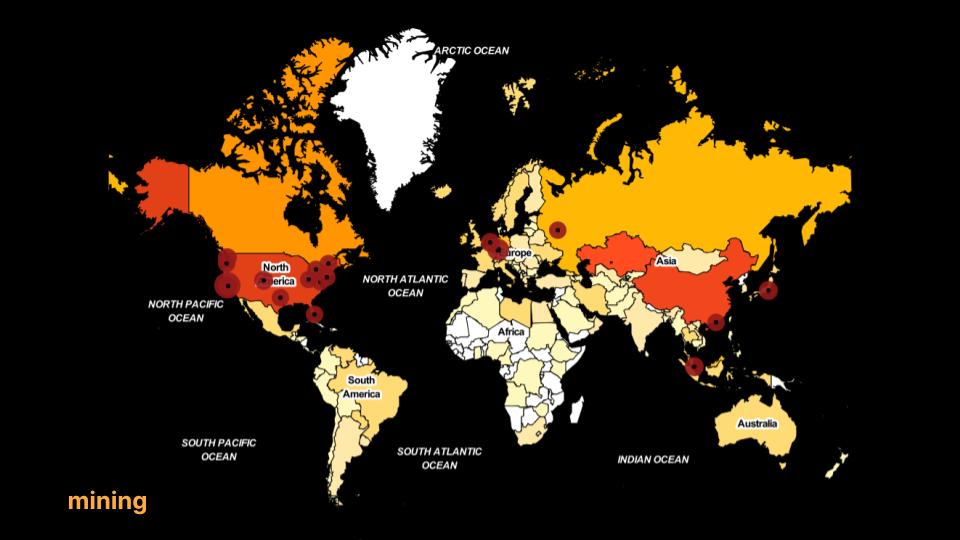

When looking at the mining leg of the stool, bitcoin just survived a massive attack on mining from the Chinese government in 2021. And again, it has come out stronger and more decentralized than before. Leading up to this event, there was a massive amount of FUD around China’s ability to control bitcoin via the mining avenue. In a matter of months, that FUD was completely dismantled, not by someone making some new argument, but by a direct attack from the Chinese government and a swift reaction by bitcoin miners to relocate outside of the country.

It’s hard to fully appreciate just how large of a feat that was. Large-scale mining operations had to shut down immediately, find a new location, sell and rebuy or transport their ASICs, negotiate power agreements, figure out a new regulatory landscape, and rebuild and restart their new facilities. Despite all that, hashrate made a new all-time high 9 months later, after dropping a full 50% from the previous all-time high. This is absolutely extraordinary, and it gives us perspective on how the bitcoin network and the mining industry across the globe can and will respond to other threats from governments.

That’s not to say the mining leg of the stool won’t face other attacks in the future, most likely from the ESG thugs, but prior to the China ban, we could only speculate as to what the response would be. Now we have hard historical evidence that should give us some confidence in the fact that bitcoin mining is decentralized enough to resist these types of attacks.

Not only is there geographic decentralization of bitcoin mining, but also decentralization in hashrate concentration. During this last bull market cycle, we certainly saw the rise of large, public mining companies who were able to tap into traditional capital markets to scale operations. It’s unavoidable, and I think one could argue somewhat good, that bitcoin mining becomes embedded in public markets in this way, as it provides a bit of a shield from state action, and it drives adoption of bitcoin generally speaking. I believe we are at the forefront of legacy energy companies realizing how powerful the adoption of mining into their operations can be. That said, it would not be good if that were the only hashrate out there. Luckily, we also saw significant growth and a resurgence of at-home mining, as well as small-to-medium-sized private operations popping up all over the place.

Mining provides permissionless access to acquiring bitcoin, which helps to strengthen the network through a wider entry point away from regulated exchanges. This is very important. Additionally, smaller operations and off-grid mining can be much more nimble when facing attacks like what we saw in China or what we will likely see from the ESG movement around the world.

When I say that widespread self-custody is critical to bitcoin’s success, a definition for the term “success” is in order. The way I define success is that bitcoin reaches the position of global money, generally accepted and used widely as a store of value, medium of exchange, and unit of account.

Bitcoin will be the new bedrock of the global economy. This is hyperbitcoinization. In the same way that most people don’t give consideration to the money they currently use, bitcoin will be embedded into their daily lives, taken as a given. We will all think in bitcoin terms, and the financial system and global economy will be built on top of it.

On the other side of this transition to hyperbitcoinization will be a world economy with a more solid foundation based on savings, equity investment, and proof-of-work instead of credit and seigniorage. I expect this will naturally breed low time preference into the global population that favors peace over conflict, earning over taking, and building over consuming – a pretty different world than we’ve been living in recently. When bitcoin wins, a lot of what’s broken in the world gets fixed, because that brokenness is downstream from the incentive structure that results from broken money. As we bitcoiners say, “Fix the money, fix the world”.

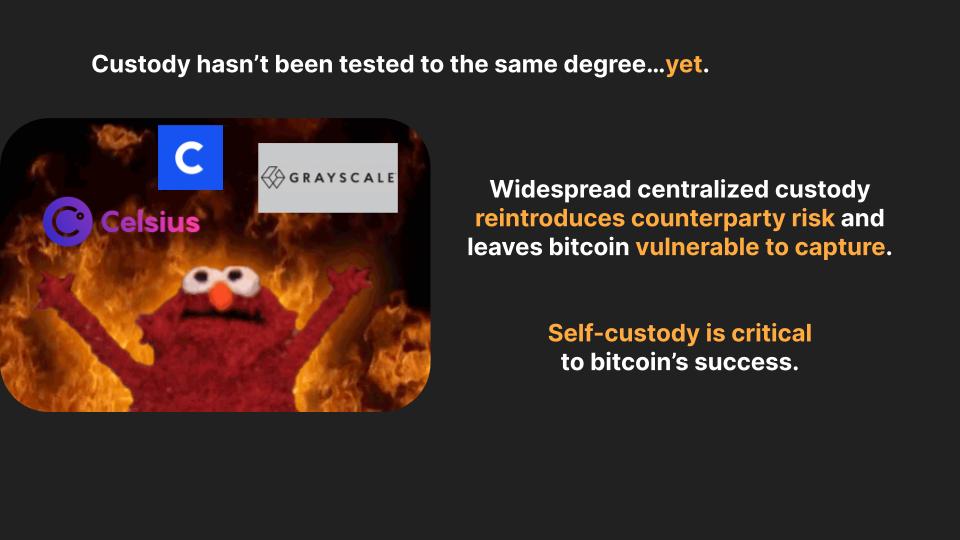

It’s fairly easy to make the case for why we should individually be holding our own keys to our bitcoin. As an individual, you cannot fully capture the benefits of bitcoin without doing so. Trusting someone else with your keys leaves you much more vulnerable to theft and loss than securing your own bitcoin. When third parties hold your bitcoin, you are reintroducing counterparty risk into the equation, which largely defeats the purpose of using bitcoin to begin with. By eliminating that counterparty risk, you’re never in a position to be censored, dependent on banking hours, or subject to someone else’s bankruptcy proceedings.

There are a lot of people who learned this lesson the hard way when their funds were frozen in Celsius or the numerous other crypto platforms out there. When Coinbase included a statement in their quarterly filings that their customers are to be considered general unsecured creditors in the event of bankruptcy, Unchained saw our single largest two week period of new clients. It’s been 7 years since the Mt. Gox hack and those coins are still locked up pending settlement of the lawsuit! To make it clear in no uncertain terms, if you do not hold your own keys, you do not own bitcoin. At best, you have an IOU.

Bitcoiners already understand these ideas, but bitcoin will continue to grow, and new people will be introduced to it for the first time without this inherent understanding, because they’ve never known anything different. As I said before, the legacy financial world requires giving up control and taking on the counterparty risk associated with trusting other people with your money, so it’s not natural for most people to immediately understand why they should hold their own bitcoin keys. As we continue to see wider adoption, we need to fight against “terms-of-service” bitcoin (as Pierre Rochard recently dubbed it) making up an increasingly larger share of the bitcoin supply.

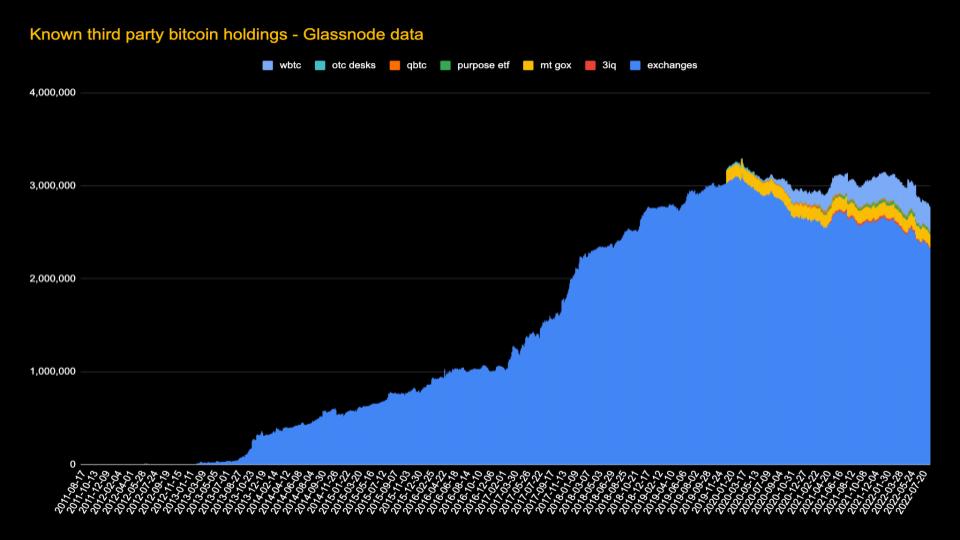

This chart uses data from Glassnode to show the amount of bitcoin being held by a subset of third parties over time. This doesn’t include all third parties (one notable missing piece is GBTC, which has over 700k btc locked up), but it gives us an idea of where we are and shows a seemingly positive recent trend.

As you can see, the rise of Coinbase in 2013 kick-started a mult-year uptrend of bitcoin held in these known third parties, exchanges, of course, being the dominant one. But since the beginning of 2020, that amount has declined from just over 3 million BTC to just below 3 million BTC. This amount still accounts for almost 15% of the total supply – and that’s just for the bitcoin in third parties that we have visibility into – the actual number is probably much higher.

Another important upcoming factor is the widely-sought-after bitcoin ETF in the US. Personally, while I see it as inevitable that it will come to market, I think the longer off, the better. True, it does give a larger swath of people easy exposure to bitcoin’s Number Go Up Technology, bringing with it a potential ocean of new capital. However, all the bitcoin that is drawn into ETFs, along with other financial products such as GBTC and BlackRock’s recently announced trust product, is already effectively captured by the regulatory state. GBTC currently trades at a greater than 30% discount to Net Asset Value, which is an indication that bitcoin trapped inside third parties is less valuable than spot bitcoin that can be withdrawn – this is a good sign. However, when combined with the balances sitting on other regulated exchanges, a significant chunk of the bitcoin supply is vulnerable to capture, along with the censorship and control that capture allows. It would be a fool’s errand for bitcoiners to embrace the short-term upside that the ETF will probably provide at the expense of hampering long-term considerations such as the effect on widespread self-custody.

Capturing bitcoin UTXOs within regulated institutions doesn’t “break” bitcoin the network in the technical sense. But it does threaten that definition of success that I just laid out. Let’s run through a thought experiment on how not taking this threat seriously could evolve.

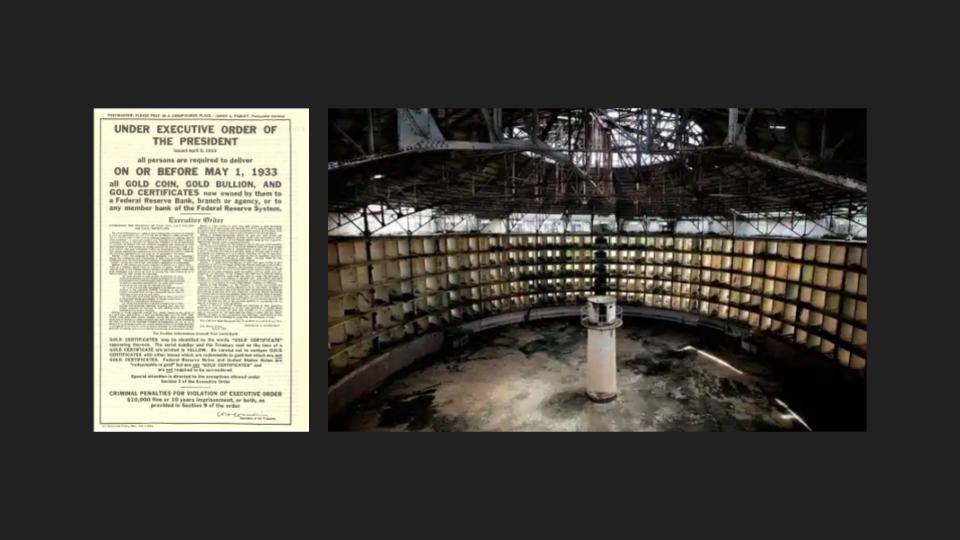

If we get to a place where a large majority of bitcoin is held in regulated exchanges, banks, or centralized products like ETFs, it becomes much easier to implement a 6102-style attack. This doesn’t have to be direct confiscation of these IOUs. The centralized custodians could simply be forced to keep all bitcoin inside a walled garden of regulatorily approved and licensed institutions. In that scenario, perhaps no bitcoin is allowed to leave the walled garden, which is enforced by whitelisting of addresses between these institutions and forbidding withdrawals out of them. From there, those institutions may be able to issue fiduciary media that is linked to bitcoin in some way, but only that fiduciary media can legally be used in the wider economy.

Without already having instilled an understanding of the importance of self-custody, people can easily be gaslighted into accepting this result and going along with it. More and more bitcoin may come into this walled garden over time, but it won’t be able to find its way out, at least not in any meaningful amounts. As ever more bitcoin gets captured, there is a reduced incentive for everyday people to run their own nodes. After all, there’s no point in running your own node if you never deal with real bitcoin. This could lead to the economic majority shifting toward these captured institutions, giving them increased ability to enforce consensus changes onto bitcoin. Of course in this scenario, there will always be an intransigent minority holding up the goal of true hyperbitcoinization, but they may stay relegated to the shadows. If this happens, the vision of success for bitcoin that I outlined will not happen, and we’ll be stuck with a new fiat boss, same as the old fiat boss.

You can’t kill bitcoin completely, and it’s possible it could even reach the heights of being a $10-20 trillion asset under this type of capture. But this outcome is not acceptable. We don’t need just digital gold. We need freedom money.

To end on a positive note, I don’t think bitcoin being captured in that way is very likely. Bitcoin and bitcoiners are very resilient and have managed to come through all previous tests stronger. There is a larger contingent of us than ever before, spread throughout the globe, stacking sats to our own keys, and working every day to orange pill someone new. That said, we as a bitcoin community cannot sit back as if bitcoin’s success is guaranteed or inevitable. We need to keep pushing for decentralization of nodes, decentralization of mining, and decentralization of custody.

Bitcoin is currently too small to be considered an imminent threat to the monetary powers that be. As it grows, it will become more obvious that its purpose is to separate money from state. Most people’s initial interaction with bitcoin will not be running a node or mining – it will be acquiring some sats. We need to take it upon ourselves to ensure that as we teach people about bitcoin, self-custody is at the forefront of the conversation, because for bitcoin to succeed, it is absolutely non-negotiable.